Originally published on 3 October 2019 in the Pasadena Independent, Arcadia Weekly, and Monrovia Weekly

Cornell University | Courtesy Photo

The road to college

The road to college involves four years of complicated planning and complex scheduling. High school students are extremely busy – homework, extra-curricular activities in art and sports, campus clubs, all compete for their time. To add to that, they have to make sure they get excellent marks in their courses and on the standardized tests. Their GPAs and SAT/ACT scores have to impress college admissions officers to really consider their application.

I know some parents who enroll their kids in SAT prep courses as early as 9th grade and some independent counselors recommend that students sit for the SAT in 10th grade. However, I feel that taking the SAT this early isn’t necessarily the best course of action – students still have so much to learn and aren’t really ready for this test. Unless there are extenuating circumstances (if the SAT is a requirement for an advanced math course, for instance) that necessitate them to take it, I would suggest waiting a bit. My daughter took her SAT and ACT the summer before her senior year. By then she had accumulated as much knowledge as high school covered.

FRESHMAN

Encourage your children to keep their focus on their schoolwork. By this time, they should have figured out what extra-curricular activities they are interested in pursuing and what sports they want to participate in. Give them guidance as they navigate this new phase in their school life, and support the choices they make.

SOPHOMORE

Depending on your children’s course choices and load, there could be standardized testing required of them. Your children should be taking AP and SAT II exams following completion of the course while the knowledge they gained in class is still fresh in their minds. The best preparation for both AP and SAT II exams is for your children to make sure they understand the subject matter and do well in all tests the teachers give in class. If there is something they don’t understand, they should right away speak to the teacher to ask for clarification or, possibly, find a tutor for additional help. The results of these standardized exams are required for college applications.

JUNIOR

Your children should be aware that junior year is the last complete year of high school performance that college admissions officers will see. They have to put more effort at doing well and getting good marks.

They should register for and take the PSAT, which is also the qualifying exams for the National Merit Scholarship. It is also a good time for your children to meet with their school counselor to make sure they are taking all the courses they need to graduate and apply to college.

Your children should also be keeping up with their extra-curricular and sports activities. College admissions officers look at several components as they try to assemble an incoming class made up of the best candidates to add to their student body.

Several area high schools hold College Fairs on campus. This is an excellent opportunity for you to see what the different colleges and universities are offering. Your children will get to meet and speak to admissions officers – usually the same people who will be reviewing your children’s application, reading the essay, and sitting around the table – who will be making their case for your children during the all-important decision-making rounds. They have a say on whether your children get accepted or denied admission to the school of their choice.

SENIOR

Eighteen year-olds are intent on getting into the college of their dreams. After all, they have spent four years preparing towards this goal. The cost of a college education may not have necessarily been top of mind for them.

However, with the ever-increasing cost of tuition, books, accommodations, and meals, a college education has become very expensive for a lot of Americans. Many parents can’t afford to send their children to college, necessitating children to take on a student loan. Today student debt is at a staggering $1.5 trillion.

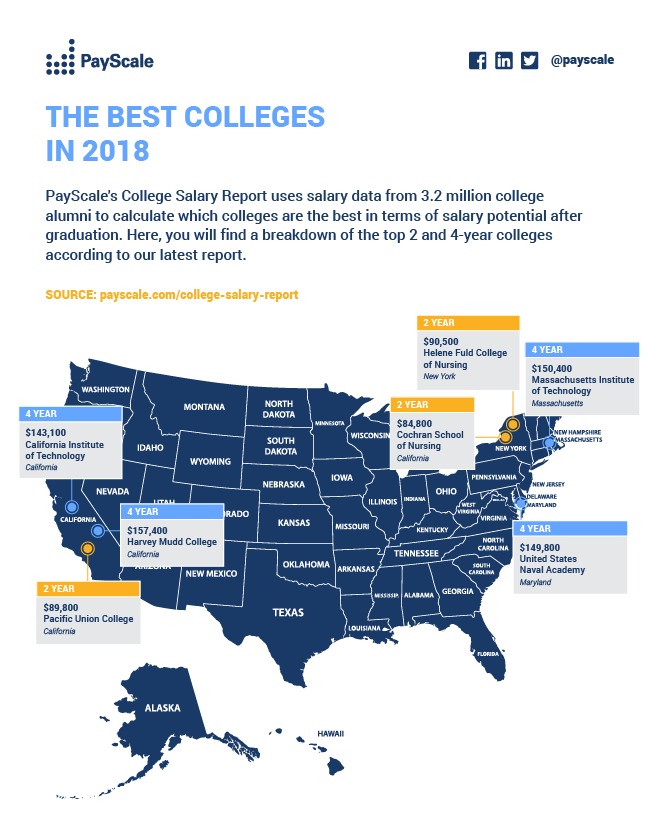

To help parents and students make informed choices, PayScale, Inc., the world’s leading provider of on-demand compensation data and software, released its annual College Salary Report for the 2019-2020 school year. Using data collected from more than 3.2 million college alumni, it provides estimates of early and mid-career pay for 2,646 associate and bachelor’s degree-granting schools in the United States.

An accompanying piece to this is a report PayScale puts out in the spring, called College Return on Investment, which details how much it will cost to attend a particular school and the earning potential of its alumni. These two reports are worth looking at when your children make decisions on what majors to take and what schools to apply to.

Your children should now be in the process of completing the common app, and finalizing their essay topic or personal statement. They should have provided the teachers who are writing their letters of recommendation with stamped envelopes.

Depending on what course your children are applying for, they may be required to send supplementary material (auditions or portfolios) with their application and they need to get those ready. Audition tapes for Arts Performance, for instance, can be uploaded on YouTube for easy access. Your children should check the website of the college or university to which they are applying about supplement material requirements. Your children’s school counselors are also a great resource as they are always in contact with college admissions officers.

If your children’s high school offers interview advice and guidance, they should take advantage of it. Basic information like what clothes and shoes to wear, in addition to how to answer questions, all help towards giving your children confidence. While this is not a professional statement, in most cases, interviewers are not as concerned about the answer applicants give, as they are about their demeanor and how they present themselves. Also, if your children are visiting a campus and an interview with an admissions officer is a requirement for application, they should take the opportunity to schedule the interview at that time. Admissions officers like to see demonstrated interest – a campus visit and interview will be remembered and noted.

Be on top of application deadlines; most schools offering Early Action or early Decision have to receive your children’s application by the 1st of November.

You and your children should be researching scholarships. Some websites include: CollegeXpress (www.collegexpress.com); Fastweb (www.fastweb.com); Free Application for Federal Student Aid (www.fafsa.ed.gov); National Merit Scholarship Corporation (www.nationalmerit.org); Scholarships.com (www.scholarships.com); Scholarships360 (www.scholarships360.org); Student Aid on the Web (www.studentaid.ed.gov). You should also attend the financial workshops being offered at your children’s high school. Most high schools offer on-site guidance, with specialists who can answer your questions.

Your responsibilities as parents are limited to offering encouragement, guidance, and moral support as your children go through this stressful time. But while you need to let your children manage this process, you should also express your concerns and expectations. Communicate with your child, the counselors, and the teachers when you have inquiries.

Be there for your children but learn when to get out of their way. Never try to communicate with the college admission officers as it is the surest way to sabotage your children’s chances for admission. Do not be overzealous about getting your children accepted to their dream university; there is a school out there that’s the right place for them. While this may sound hollow now, the counselors at your children’s school and the admissions officers at the colleges, or universities to which your children are applying, are actually the experts at finding the best fits.