Originally published on 5 November 2020 in the Pasadena Independent, Arcadia Weekly, and Monrovia Weekly

The road to college

FRESHMAN

With all the wildfires raging on everywhere in Southern California, it would be a welcome relief for the weather to cool down and bring us some rain. And as we fully ease into the fall season and further into the school year, I hope your children have also completely settled in as high-schoolers. Encourage your children to focus on their studies and to make use of all the resources available at their school to accomplish all the work required to succeed in each course. The goal is not just to pass, however, but to make the best grade they are capable of getting.

Ideally, they should be up-to-speed in all their classes but if there is anything about the course they can’t grasp, they need to seek assistance from teachers. Most teachers will meet with students after class to provide the necessary tutorial lesson. They have to ask right away or they will fall behind all the more as the school year goes on.

All their end-of-year grades are reported and their GPA is the single most important component of the academic picture they present to the universities to which they will apply. It will show how well they did in high school and how prepared they are to go to college.

If your children are particularly good at one sport, encourage them to join their school’s competitive team. Excellence in sports can be used as a hook to get into college; some universities offer lucrative athletic scholarships. They should ask their coach to help them determine the NCAA requirements.

They should have identified other extra-curricular activities they want to participate in, whether they’re in the arts or school clubs. An important thing for them to bear in mind is to make sure they continue that interest throughout high school – admission officers want to see depth of involvement.

SOPHOMORE

Most universities look at 10th grade as a fundamental year in high school. Your children should have already made a smooth transition from their middle school life and are enthusiastically exploring their various interests and are applying these towards extra-curricular work. They should be actively participating in sports, or arts, their school newspaper, or their yearbook.

The class deans should be working with your children in evaluating their class performance and workload to make sure they are on track and are making the grade. Together with their class dean, your children should be preparing for standardized testing and junior year course options.

Additionally, your children can start looking at various colleges offering the course they might consider taking.

JUNIOR

This is an important year for your children. They should register for all the standardized tests required for college application. They need to be in constant communication with their counselor to ensure they are on track for graduation and college admission.

Encourage your children to focus on getting good grades. This year’s is the last complete school year marks the college admissions officers will see when your children send in their application. Their GPA is the most reliable and significant predictor of how well they are ready for college work.

Several high schools in the area have held college fairs on campus and you and your children would have met the representatives of the various colleges to which they might consider applying. Your children should be researching these schools’ requirements and keeping track of the universities which offer the courses they are interested in pursuing.

SENIORS

Eighteen year-olds are intent on getting into the college of their dreams. After all, they have spent four years preparing towards this goal. The cost of a college education may not have necessarily been top of mind for them.

However, with the ever-increasing cost of tuition, books, accommodations, and meals, a college education has become very expensive for a lot of Americans. Many parents can’t afford to send their children to college, necessitating children to take on a student loan. Today student debt is at a staggering $1.5 trillion.

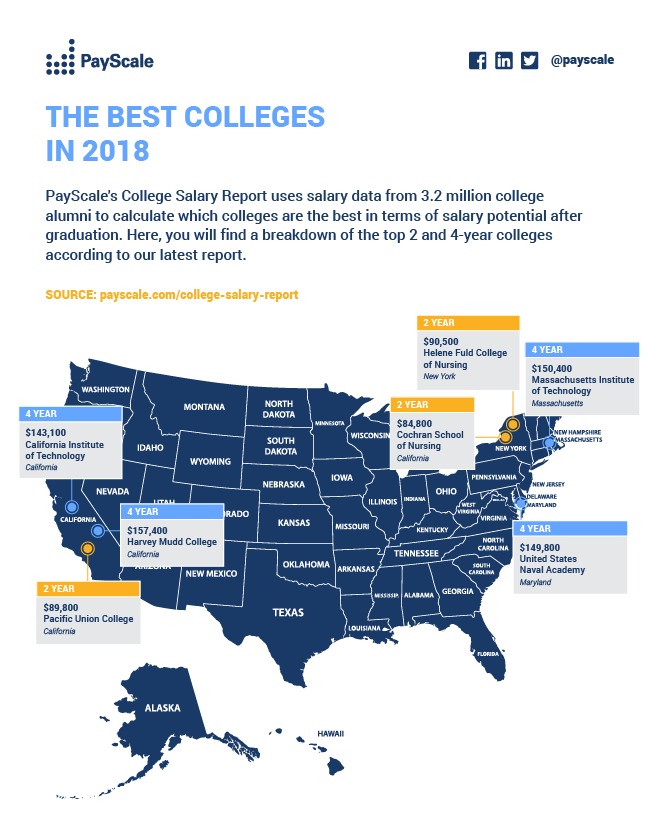

To help parents and students make informed choices, PayScale, Inc., the world’s leading provider of on-demand compensation data and software, released its annual College Salary Report for the 2019-2020 school year. Using data collected from more than 3.2 million college alumni, it provides estimates of early and mid-career pay for 2,646 associate and bachelor’s degree-granting schools in the United States.

An accompanying piece to this is a report PayScale puts out in the spring, called College Return on Investment, which details how much it will cost to attend a particular school and the earning potential of its alumni. These two reports are worth looking at when your children make decisions on what majors to take and what schools to apply to.

Your children should take the AP exam and SAT Subject Test if the colleges they’re applying to require them. They also should have already sent out their application early this month if they were trying for Early Action (EA) or Early Decision (ED). They should notify the universities of any honors they received since mailing their application; they have to make sure their school sends out a recent transcript, and all their standardized test results have been forwarded.

Some universities will offer alumni interviews and I would advise your children to plan ahead because the report will become part of their admission file. Here are some things they should do: arrive on time – in fact, show up early; dress conservatively and comfortably – no tank tops, no bare midriffs, no cut-off jeans; make eye contact and listen well; be positive – stress your strengths and explain your weaknesses, but don’t dwell on the negative and don’t complain; answer all the questions – if you’re confused, ask for clarification; keep the conversation going; be prepared to ask thoughtful questions of your interviewer; try not to lead the conversation into a ‘trouble’ area – if you don’t know much about current events, don’t direct the conversation there; be honest; send a thank you note.

Most universities will mail out their acceptance letters in mid-December. As your children await word from the college, they might want to keep writing all the supplemental essays required by the universities to which they will apply for the regular decision round. Admission to their EA school isn’t binding so they can still apply to other colleges, thus not limiting their options. However, an acceptance to their ED school is binding and they are required to matriculate if admitted.

In the meantime, you children should make sure they are doing well academically. Some universities require the first semester grades, or the first quarter grades if they’re applying for EA/ED. In fact, your children shouldn’t let up on academics because a college can still rescind their offer of acceptance if a student’s grades have fallen below acceptable level.

Likewise, make sure your children are continuing to participate in athletics and extra-curricular activities. These sometimes help them relieve the stress of the college application process.

This is also the time to research scholarships. Some websites that could prove useful are: CollegeXpress (www.collegexpress.com); Fastweb (www.fastweb.com); Free Application for Federal Student aid (www.fafsa.ed.gov); National Merit Scholarship Corporation (www.nationalmerit.org); Scholarships.com (www.scholarships.com); Scholarships360 (www.scholarshops360.org); Student Aid on the Web (www.studentaid.ed.gov). You and your children should talk to their school’s financial aid officer for guidance on filling out financial aid applications.